"Great IT leadership is not merely about technology, but the ability to envision and execute transformative strategies that drive innovation and shape the future." – Sanjay K Mohindroo

Welcome to our comprehensive catalog of publications showcasing the remarkable journey of a strategic IT leader. Dive into a wealth of knowledge, exploring innovations, transformation initiatives, and growth strategies that have shaped the IT landscape. Join us on this enlightening journey of strategic IT leadership and discover valuable insights for driving success in the digital era.

AI-Powered Personal Assistants for Executives: What Works and What Doesn’t.

Sanjay K Mohindroo

How AI executive assistants reshape leadership, strategy, and risk in modern enterprises.

Every executive today is overwhelmed.

Board decks pile up. Investor emails never stop. Strategy reviews collide with operational escalations. The calendar becomes a battlefield.

Into this chaos walks the promise of AI-powered personal assistants.

Schedule meetings automatically. Summarize reports in seconds. Draft responses instantly. Track action items. Surface insights. Reduce cognitive load.

The pitch is simple: give leaders back their time.

But here is the uncomfortable truth.

Most executive AI assistants underdeliver. Some create new risks. A few genuinely transform how leaders operate.

After working closely with senior technology leaders, navigating digital transformation leadership, and emerging technology strategy, I have observed a clear pattern. The value of AI assistants does not depend on the technology alone. It depends on how leadership integrates them into the executive decision environment.

This is not a tool discussion. It is a leadership design discussion.

This is not about convenience. It is about competitive edge.

Boards are asking tougher questions about productivity, agility, and cost discipline. CIO priorities increasingly revolve around automation, operating model redesign, and intelligent workflows. Leaders are expected to process more information, faster, and with higher accountability.

AI-powered executive assistants sit at the intersection of:

· Business velocity

· Risk management

· Information asymmetry

· Decision quality

When implemented well, they accelerate data-driven decision-making in IT and business. When implemented poorly, they introduce compliance exposure, privacy concerns, and decision distortion.

It is also a signal to the organization.

If the executive team uses AI intelligently, it sets cultural permission for adoption. If they dismiss it or misuse it, enterprise adoption stalls.

This is why AI assistants are a boardroom topic. They influence how strategy is formed, how information flows, and how leaders think.

Key Trends Shaping the Space

Several shifts are defining what works and what fails.

First, context-aware intelligence is improving rapidly. Modern AI assistants no longer operate as generic chatbots. They integrate with email, collaboration tools, CRM systems, ERP data, and project platforms. They observe patterns. They learn preferences. They surface relevant information before it is requested.

Second, executive workloads are becoming data dense. Leaders receive structured dashboards and unstructured inputs simultaneously. Market signals arrive from customer calls, regulatory updates, and analyst reports. AI assistants now attempt to synthesize this noise into coherent briefings.

Third, privacy and governance scrutiny is intensifying. With regulations around data protection and AI governance tightening globally, feeding sensitive board discussions into public models without controls is becoming a serious governance risk.

Fourth, IT operating model evolution is accelerating. As organizations move toward platform-based and product-centric structures, executives require real-time cross-functional visibility. AI assistants promise to stitch together fragmented data across silos.

Yet despite these advances, adoption remains uneven.

Why?

Because technology capability is not the same as executive trust.

Insights and Lessons

What Works: AI as a Cognitive Amplifier

The most effective use of executive AI assistants is augmentation, not delegation.

When AI summarizes a 50-page board pack into a three-page briefing with risks highlighted, it saves hours. When it analyses recurring themes across customer complaints and flags patterns, it adds clarity. When it drafts a response that the leader refines, it accelerates communication.

It works when it supports thinking, not replaces it.

Leaders who treat AI as a thinking partner achieve higher productivity. Leaders who expect it to “handle things” often disengage from critical nuance.

What Fails: Blind Automation

Where AI fails is in high-context, high-stakes communication.

An assistant might draft an email to a regulator. It might summarize a sensitive HR issue. It might propose a strategy memo tone that feels polished but misses political reality.

Executives operate in environments shaped by relationships, power dynamics, and trust. AI does not fully understand subtext.

Blindly sending AI-generated content without judgment can damage credibility.

Another failure point is over-integration. When assistants are connected to too many systems without governance, data exposure risk increases. Leaders sometimes forget that AI tools learn from inputs. Sensitive merger discussions or confidential pricing strategies can leak into training data if safeguards are weak.

What Leaders Often Miss

The real transformation is not time savings. It is cognitive bandwidth.

The highest-performing executives I observe use AI to reduce routine friction so they can focus on strategic judgment.

They use AI to prepare, not to decide.

They use AI to explore scenarios, not to commit to them.

The mistake many leaders make is measuring success by minutes saved. The real metric is clarity gained.

A Practical Framework for Executive AI Assistants

For leaders evaluating or deploying AI assistants, I suggest a simple four-layer model.

Layer 1: Task Automation

This includes scheduling, meeting notes, transcription, email drafting, and document summarization.

Low risk. High productivity gain.

Action Step: Pilot with a small group. Measure reduction in manual effort.

Layer 2: Insight Aggregation

This includes pulling signals from dashboards, highlighting anomalies, and identifying trends across projects or markets.

Moderate risk. High strategic value.

Action Step: Define clear data boundaries. Ensure model outputs are auditable.

Layer 3: Decision Support

Scenario modelling. Risk analysis. Financial projections. Competitive mapping.

High impact. Higher risk.

Action Step: Maintain human review at all times. AI proposes. Humans decide.

Layer 4: External Communication

Board memos. Investor updates. Regulatory submissions.

Highest reputational risk.

Action Step: Use AI for structuring and clarity. Final language must reflect the executive voice.

This layered approach aligns with emerging technology strategy and protects against uncontrolled expansion.

A Realistic Case Scenario

A global CIO recently introduced an AI assistant integrated into the leadership workflow.

Phase one focused on meeting summaries and action tracking. Executive satisfaction rose quickly.

Phase two added automated briefings pulling from IT service data, project dashboards, and financial metrics. The assistant began flagging risks in major transformation programmes before monthly reviews. Decision cycles shortened.

However, in phase three, the CIO allowed the system to auto-draft board communications based on internal data feeds. Subtle context around stakeholder politics was lost. A board member felt blindsided by the tone of a status update.

The lesson was immediate.

AI can surface data. It cannot fully interpret governance dynamics.

After adjusting the model to restrict drafting rights and increase review layers, adoption stabilized and trust improved.

This is the pattern I see repeatedly. Success comes from disciplined boundaries.

The Future Outlook

Executive AI assistants will not remain reactive tools. They will become proactive.

They will anticipate information gaps before meetings. They will simulate impact scenarios in real time during strategy sessions. They will detect early risk signals across supply chains or cybersecurity exposures.

But as capability increases, so does responsibility.

Boards will ask:

· Where does this assistant pull data from?

· Who governs it?

· How is bias managed?

· How are audit trails maintained?

Digital transformation leadership now includes stewardship of intelligent systems. CIO priorities must expand to include executive AI governance.

The leaders who thrive will not be those who adopt the fastest. They will be those who adopt with discipline.

Here is the real question.

Are we using AI assistants to reduce noise, or are we introducing a new layer of complexity?

The difference lies in design.

I am curious how other

senior leaders are approaching this.

Are you treating executive AI as a personal productivity tool, or as part of

your IT operating model evolution?

The conversation is just beginning.

#DigitalTransformationLeadership #EmergingTechnologyStrategy #CIOPriorities #ITOperatingModel #ExecutiveAI #DataDrivenLeadership #AIinBusiness #BoardroomTechnology #StrategicIT

Ten Moments That Shaped Me as a Technology Leader.

Sanjay K Mohindroo

A career built in pressure, scale, and truth

Ten moments. Three decades. One clear truth about technology leadership.

Technology careers do not turn on titles. They turn on moments. Moments where systems strain, teams doubt, money bleeds, or trust wavers. Over three decades across banking, global services, conglomerates, and public sector systems, I faced moments that shaped how I lead today. Each one forced a choice. Speed or care. Control or trust. Comfort or truth. This post reflects on ten such moments. Not as a victory lap. As a leadership audit. The aim is simple. Share real lessons that matter to senior leaders building resilient systems and credible teams in a world that no longer forgives weak judgment.

Ten moments. Hard calls. Real outcomes. This is what shaped my leadership.

Careers do not evolve in straight lines. They bend under load.

My path across global banks, large service firms, family-owned conglomerates, and public systems taught me one truth. Technology leadership is not about tools. It is about judgment under pressure.

Each role placed me in moments where the cost of delay was high and the margin for error thin. Systems were large. Teams were global. Budgets were real. Failure showed fast.

These moments defined how I think about trust, scale, risk, and execution. They still shape every call I make today.

Here are the ten moments that mattered most. #TechLeadership #CareerMoments

Scale reveals leadership gaps

Early in my career, I was responsible for environments that ran far beyond the comfort scale. Thousands of servers. Petabytes of data. Teams are spread across zones.

Scale strips away illusion. Process gaps surface fast. Weak handoffs break systems. Vague roles cause delay.

That moment taught me this. Leaders must design for scale before scale arrives. Systems grow faster than habits. #InfrastructureLeadership

Cost pressure sharpens clarity

At a global services firm, cost was not abstract. It hit the margin every month. Infrastructure sprawl was killing value.

We consolidated servers. Virtualized aggressively. Renegotiated contracts. The result was a 50 percent cut in spending and stable service.

The lesson was clear. Cost control is not austerity. It is respect for capital. Leaders who dodge cost talk lose trust. #CostDiscipline

People scale beats system scale

Managing over two thousand administrators taught me this fast. Tools matter. People matter more.

We cross-trained teams. Broke silos. Rotated ownership. Output rose. Escalations fell. Morale improved.

Leadership is not command. It is a structure that lets people win. #TeamLeadership

Process debt hurts more than tech debt

At a global bank, ticket queues crossed ten thousand. The issue was not skill. It was flowing.

We outsourced smartly. Rebuilt queues. Matched skill to task. The queue dropped to one thousand.

Process debt hides in plain sight. Leaders must attack it with the same force as broken code. #OperationalExcellence

Ratios tell the truth

Improving the server-to-admin ratio from 300 to over 1,100 per person was not a badge move. It was survival.

Automation replaced heroics. Standards replaced guesswork. Metrics replaced noise.

Ratios cut through spin. Leaders who ignore them drift from reality. #MetricsMatter

Conglomerates need common ground

At a large diversified group, tech sprawl was cultural. Each unit ran its own playbook.

We unified routing. Optimized links. Flow rose. Cost fell. Data moved faster.

Leadership here meant alignment without force. Influence beats mandate. #EnterpriseIT

Vendor talks test the backbone

Licensing negotiations with global vendors are pressure tests. Volume hides waste. Silence hides risk.

We consolidated licenses. Enforced compliance. Cut volume by 30 percent with zero exposure.

Leadership means owning the table. Vendors respect clarity, not caution. #VendorManagement

Digital bets need business skin

Launching an automotive e-commerce platform was not a tech win alone. It had to work for users and revenue.

We built fast. Listened to buyers. Added pickup and drop. Adoption followed.

Digital only matters when it earns trust from users and owners alike. #DigitalTransformation

AI forces value discipline

Deploying on-prem AI was not about trend chasing. It was about speed, privacy, and cost.

We built our own server. Tuned cooling. Model speed rose by 30 percent. Data stayed local.

AI without purpose is noise. Leaders must demand clear use cases. #AILeadership

Energy makes or breaks scale

Cooling costs kill data centers quietly. We studied energy flow. Moved to direct-to-chip cooling.

Cooling cost dropped by 30 percent. Stability rose.

Sustainability is not a slogan. It is an engineering choice. #GreenIT

Patterns Across These Moments

Judgment over hype

Across roles and regions, one pattern stayed constant. Tools change. Pressure stays.

Leaders fail when they chase shine and dodge friction. Strong leaders face friction early.

Scale rewards truth. Delay punishes the ego. #LeadershipLessons

Case

Banking, services, conglomerates, public systems

These moments played out across sectors. The lesson held firm.

Banking taught discipline. Services taught scale. Conglomerates taught alignment. Public systems taught resilience.

Leadership adapts, but core values do not. #ExecutiveLeadership

Leadership is revealed in strain

The moments that define a career do not come with warning. They come with urgency.

Leaders earn trust when they act with clarity, cut noise, and protect the system over ego.

That is the work. That is the role. #TechnologyLeadership

Careers are shaped by moments, not milestones.

These ten moments taught me to value truth over comfort, structure over heroics, and clarity over charm.

Technology will keep shifting. Pressure will rise. The leaders who endure will be the ones who decide early, listen hard, and act clean.

I invite you to reflect. Which moment shaped you most? And what did it demand from your leadership?

#TechnologyLeadership #CareerMoments #CIO #ITLeadership #DigitalTransformation #AI #Infrastructure #EnterpriseIT #ExecutiveLeadership

The AI Revolution Isn’t Just Another Chapter—It’s a Different Book Entirely.

Sanjay K Mohindroo

A sharp, executive-level perspective on how the AI revolution differs from past disruptions, its impact on jobs, and what leaders must do to stay relevant.

Every major technological revolution has disrupted jobs, reshaped industries, and forced societies to adapt. From steam engines to computers, we’ve endured—and grown stronger.

But the AI revolution is not a repeat cycle.

This time, the speed is exponential—the impact cuts across both blue-collar and white-collar roles. Middle management is thinning. Decision-making itself is being automated.

Survival is not the question. Relevance is.

Leaders who understand this shift—and act early—will not just endure change. They will shape it.

The Comfortable Myth of “We’ve Been Here Before”

In every boardroom conversation about AI, I hear a familiar line:

"We’ve seen this before. People adapt. Jobs evolve."

That statement is comforting. It’s also incomplete.

Yes, society survived the Industrial Revolution. Yes, we adjusted to computers and the internet. But those transitions had one common trait—they replaced how work was done, not who thinks.

AI is different.

For the first time, machines are not just executing tasks. They are participating in judgment, pattern recognition, and decision support. That changes the equation entirely.

And if leadership treats this as “just another wave,” they will be late—dangerously late.

Then vs Now: What Past Revolutions Actually Changed

From Muscle to Machine

The Industrial Revolution replaced physical effort, not human direction

The steam engine and mechanization shifted labor from fields to factories. Blue-collar roles changed, but human oversight remained central.

Work became more productive. It did not become autonomous.

From Paper to Digital

The Computer Revolution enhanced efficiency, not accountability

When computers entered the workplace, they accelerated processes. Spreadsheets replaced ledgers. Emails replaced memos.

But decision-making stayed human.

Even automation relied on structured inputs. The human brain still held the edge in ambiguity.

What Makes the AI Revolution Fundamentally Different

From Execution to Cognition

Machines are no longer just tools—they are participants

AI is not just optimizing workflows. It is entering domains that were once considered uniquely human:

- Drafting strategies

- Analyzing risk patterns

- Generating insights

- Supporting executive decisions

This is where the shift becomes structural.

The value chain is moving upward—from doing to deciding.

And that has deep implications for #Leadership, #CIO priorities, and workforce design.

The Silent Shift: The Erosion of the Middle Layer

Why Middle Management Is Under Pressure

Intelligent systems are compressing coordination roles

In most organizations, middle management plays three roles:

1. Translating strategy into execution

2. Aggregating information upward

3. Supervising operational consistency

AI is now doing all three—faster and with fewer biases.

Dashboards replace reporting layers. Predictive systems reduce the need for manual oversight. Decision-support tools shorten feedback loops.

The result?

A structural compression of the middle layers.

Not overnight. But steadily.

This is not about cost-cutting. It is about efficient architecture.

Blue-Collar Work: The Next Phase of Automation

From Mechanization to Autonomy

Physical work is no longer safe from intelligent disruption

Earlier automation replaced repetitive manual labor. Now, AI combined with robotics is moving into adaptive environments:

- Warehousing

- Logistics

- Manufacturing

- Field services

The difference is subtle but critical.

Machines are no longer just repeating tasks. They are adjusting in real time.

That reduces dependency on human intervention.

The impact will not be uniform. But the direction is clear.

“AI Will Create More Jobs Than It Destroys” Is Incomplete

The Real Issue Is Not Job Count—It’s Job Composition

This is where most conversations lose depth.

Yes, new roles will emerge. They always do.

But here’s the uncomfortable truth:

The rate of job creation will not match the speed of job displacement in the same skill bands.

That creates friction.

- Entry-level roles shrink due to automation

- Mid-level roles are compressed due to AI augmentation

- Senior roles expand—but require sharper thinking, not tenure

This is not a volume problem. It is a capability mismatch.

And that mismatch is where organizations—and careers—will struggle.

The New Survival Model: From Skill to Signal

Why Reskilling Alone Is Not Enough

The market does not reward effort. It rewards relevance.

Reskilling has become a popular answer. It sounds right. It often fails in execution.

Why?

Because most reskilling focuses on tools, not thinking.

Knowing a new platform does not increase relevance. Understanding how to create value with it does.

The shift required is deeper:

- From task execution → problem framing

- From process knowledge → decision quality

- From experience → adaptability

This is where professionals need to reposition themselves.

Not as operators. But as interpreters of complexity.

Relevance in the AI Era: What Actually Works

1. Build Decision Depth

Your value lies in how you think, not what you do

AI can generate options. It cannot own accountability.

Leaders who can evaluate trade-offs, assess risk, and make clear calls will remain indispensable.

2. Strengthen Business Context

Technology without business alignment is noise

Understanding revenue models, cost drivers, and customer behavior is now critical.

Pure technical expertise is no longer enough.

3. Reduce Dependency on Hierarchy

Authority is shifting from position to insight

Influence will come from clarity, not titles.

This is already visible in high-performing organizations.

4. Communicate with Precision

Clarity is becoming a competitive advantage

In a world flooded with AI-generated content, clear thinking stands out.

Leaders who can articulate complex ideas simply will lead conversations—and decisions.

Strategic Takeaways

- Treat AI as a structural shift, not a technology upgrade

- Redesign organizations, not just processes

- Expect compression in middle layers—plan proactively

- Invest in cognitive capability, not just technical training

- Align IT strategy with business outcomes, not tools

- Build cultures that reward thinking, not activity

This is where #DigitalTransformation becomes real.

Survival Is Guaranteed. Relevance Is Not

Human beings are resilient. We adapt. We move forward.

That will not change.

But relevance in this era will not come from experience alone. It will come from clarity, adaptability, and the ability to make better decisions under uncertainty.

The leaders who understand this early will not chase the future.

They will shape it.

#Leadership #AIRevolution #FutureOfWork #DigitalTransformation #CIO #ExecutiveLeadership #WorkforceStrategy #AI #BusinessStrategy #Innovation #OrganizationalDesign

The CIO as Chief Educator.

Sanjay K Mohindroo

The modern CIO is no longer a tech head alone. The role now shapes minds, skills, and trust across the firm.

The CIO role is changing fast. Teaching tech sense now shapes trust, speed, and value across the firm.

Where technology sense becomes shared strength

The CIO role has crossed a clear line. It is no longer enough to manage systems, budgets, and vendors. Today’s CIO must shape how people think about technology. This includes boards, peers, teams, and partners. The CIO has become the chief educator on emerging technology.

This shift is not soft work. It is strategic work. When leaders fail to grasp AI, data, cloud, cyber risk, or automation, firms slow down or make weak calls. When teams copy tools without context, value slips away. The CIO now carries the task of building shared understanding, sharp judgment, and calm confidence across the enterprise.

This post makes a clear case. Education is not a side duty. It is the core lever of impact for modern CIOs. Through real cases, sharp views, and grounded lessons, this piece invites debate on how CIOs shape culture, trust, and speed by teaching, not preaching.

Readers are encouraged to react, challenge, and add their views. This is a live idea, not a closed theory. #CIOLeadership #EmergingTech #DigitalTrust

A quiet gap at the top

Walk into any boardroom today. You will hear bold talk about AI, data, cyber risk, and scale. Scratch a bit deeper, and the gap shows. Many leaders nod without grasping. Many teams run tools they do not fully trust. This gap is not about skill. It is about shared sense.

Technology now shapes every bet a firm makes. Cost, speed, reach, risk, and brand all flow through tech choices. Yet many firms still treat tech sense as a private skill locked inside IT.

That model is broken.

The CIO sits at the fault line between promise and panic. One side sees magic. The other fears loss. The CIO’s real task is to steady both sides with clarity. This happens through education, not decks or jargon, but clear thinking made simple.

This is where the CIO steps into the role of chief educator.

The Shift in Power

From gatekeeper to sense maker

The old CIO guarded systems. The new CIO shapes meaning.

Cloud removed walls. SaaS spreads tools across teams. AI now writes, predicts, and decides. Control no longer sits in one room. Sense must travel across the firm.

When sense fails, chaos follows. Shadow tech grows. Risk hides. Spend leaks. Trust drops.

The CIO who educates sets the frame. They explain what a tool can and cannot do. They show trade-offs. They link tech moves to business goals. They speak in plain words. They ask sharp questions.

Education here is not a class. It is a habit. It shows up in reviews, board talks, town halls, and hallway chats.

This shift marks a deeper truth. Influence now beats control. #TechLeadership #DigitalMindset

Education as Strategy

Clarity beats speed without sense

Speed gets praise. Sense gets results.

Firms rush into tools because rivals do. Many adopt AI pilots that stall. Others overinvest in platforms that teams resist. These are not tech failures. They are learning failures.

The CIO who teaches slows the rush at the right moments. They help leaders ask better questions before buying. They frame risk in real terms. They explain data limits. They stress ethics without fear talk.

This creates a rare asset. Calm confidence.

When people understand tech, they act with purpose. They test wisely. They scale when ready. They stop when needed.

Education becomes a strategic lever. It aligns pace with sense. #StrategicIT #DigitalClarity

Case Study

Microsoft and the shared AI frame

When AI tools entered daily work, confusion spread fast. Promise clashed with fear. Leaders asked if jobs would vanish. Teams asked if the data was safe.

Microsoft took a clear path. Senior tech leaders spoke early and often. They framed AI as a co-worker, not a threat. They showed limits as well as gains. They trained leaders first, not last.

This was not mass training alone. It was a shared language. Leaders learned how to talk about AI in simple terms. Teams heard the same message across roles.

The result was trust. Adoption followed trust, not hype.

The lesson is sharp. Teaching the frame matters more than teaching the tool. #AILeadership #TrustInTech

Boardrooms Need Teachers

Where tech sense shapes capital

Boards now face tech calls every quarter. Cloud spends. Data risk. AI use. Cyber events. These are not side notes. They shape value.

Many boards still lack a deep tech sense. This is not a flaw. It is reality.

The CIO fills this gap by teaching up. Not with slides full of terms, but with stories and trade-offs. They explain risk as impact. They link spending to outcomes. They show options, not orders.

This changes the board tone. Fear fades. Debate improves. Decisions sharpen.

A CIO who educates the board earns trust that lasts through storms. #BoardLeadership #TechGovernance

Case Study

Capital One and data sense at scale

Capital One moved early into cloud and data-driven work. This shift was not only technical. It was cultural.

The CIO team invested in data education across roles. Product heads, risk teams, and ops leaders learned how data models worked. Limits were clear. Bias was discussed openly.

This shared base reduced friction. Teams spoke the same language. Data calls became faster and safer.

The bank did not chase every tool. It made sense first.

The result was steady innovation without panic. #DataLeadership #EnterpriseLearning

Teams Learn from Signals

Culture forms in small moments

People watch what leaders do more than what they say.

When a CIO explains a failed pilot with honesty, teams learn from it. When a CIO admits limits, teams learn the truth. When a CIO links tech to purpose, teams care.

Education shows up in these signals. It is woven into reviews, post-mortems, and roadmap talks.

This shapes culture. Curiosity grows. Fear drops. Smart risk rises.

A CIO who teaches builds teams that think, not just follow. #ITCulture #TechEducation

Case Study

Shopify and the clear tech narrative

Shopify faced fast growth and fast change. Tools evolved. Teams spread.

Leadership made tech sense a shared story. Internal talks focused on the first rules, not tools. Automation was framed as scale, not cost-cutting. Limits were stated early.

This kept teams aligned even during tough resets.

The insight stands. Clear stories outlast tool cycles. #DigitalStorytelling #Leadership

The Hard Edge of Education

Truth without comfort

Teaching is not soft talk. It includes hard truths.

The CIO must say when a tool is wrong. They must push back on hype. They must warn when the risk rises. They must state when skills lag.

This takes spine. It may slow down deals. It may upset peers.

Yet this is the core duty. Sense over speed. Truth over noise.

A CIO who avoids this role leaves a vacuum. Hype fills it fast.

Education demands courage. #CIOCourage #TechTruth

The Personal Shift

From expert to mentor

Many CIOs rose by being the sharpest expert in the room. This no longer scales.

The new edge lies in shaping others. Asking better questions. Listening. Framing choices.

This shift feels risky for some. It is also freeing. The CIO moves from solver to shaper.

Mentorship replaces command. Dialogue replaces defense.

This is where long-term impact lives. #ModernCIO #LeadershipShift

Shared sense is the real moat

Tools copy fast. Vendors change. Skills age.

Shared sense lasts.

When a firm thinks clearly about tech, it moves with purpose. It avoids traps. It earns trust.

The CIO who educates builds this moat. Quietly. Steadily. With intent.

This role is not optional. It defines relevance.

The CIO who teaches leads

The CIO role has entered a new chapter. Control faded. Influence rose. Education became the core act of leadership.

This is not about running classes. It is about shaping thought. Framing risk. Building trust. Enabling wise speed.

Firms that win will not be those with the most tools. They will be those with the clearest minds.

The CIO stands at the center of this shift.

Now the question moves to you.

Where does education show up in your role today? Where does it fall short? What have you seen work or fail?

Share your view. Challenge the idea. Add your case. The best insights will come from the debate that follows. #CIOLeadership #EmergingTech #DigitalTrust

#CIOLeadership #EmergingTech #TechEducation #DigitalLeadership #ITStrategy #AILeadership #TechGovernance #EnterpriseCulture

Relevance Is a Moving Target: Why Most Leaders Are Already Behind on AI.

Sanjay K Mohindroo

A sharp, executive-level perspective on staying relevant in the AI era. Practical insights for CIOs, CEOs, and business leaders navigating workforce and strategy shifts.

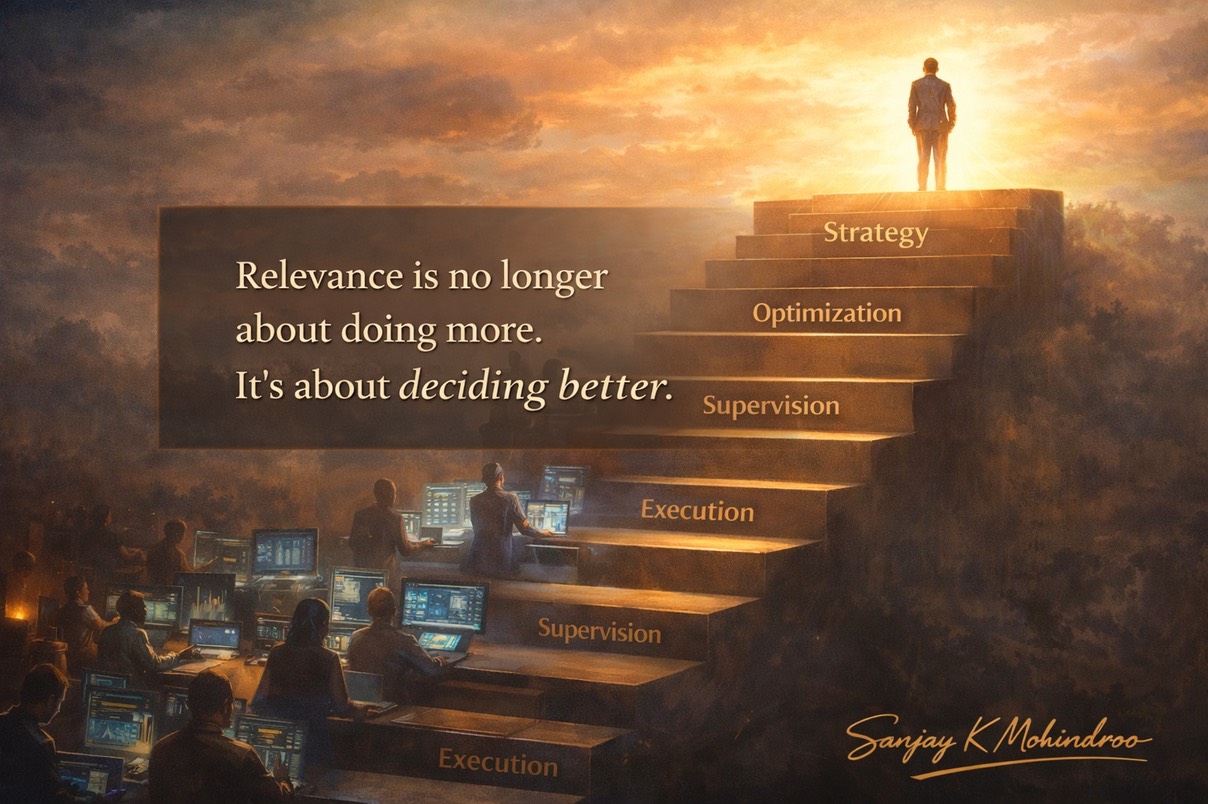

AI is not just changing how work gets done—it is redefining what makes a role valuable. The shift is subtle but decisive. Execution is losing value. Judgment, system thinking, and adaptability are gaining it.

Leaders who treat AI as a tool will fall behind. Those who treat it as a structural shift in value creation will move ahead.

The path forward is clear: evolve from doing work to shaping how work happens.

The Quiet Shift Most Leaders Are Missing

In boardrooms, I still hear a familiar question:

“How will AI impact our business?”

It sounds reasonable. It’s also the wrong question.

Because AI is not waiting to “impact” anything. It is already reshaping how value flows inside organizations.

The real issue is not adoption. It’s relevance.

I’ve seen this pattern before—during large ERP rollouts, during cloud transitions, during global outsourcing waves. But this time feels different.

Those shifts changed how work was done.

This one is changing who remains valuable while work is being done.

And that’s where most leadership conversations are still lagging.

The Relevance Curve Is Rewriting Roles

From Execution to Strategic Leverage

Every role today is moving along a simple but powerful progression:

Execution → Supervision → Optimization → Strategy

This is not a theory. It is visible across industries.

Execution is the process of performing tasks manually. It is predictable. Repeatable. And now, increasingly automated.

Supervision is the process of humans overseeing systems and AI outputs. It requires awareness, but not deep control.

Optimization is where real leverage begins. This is where people improve systems, refine outputs, and increase efficiency.

Strategy sits at the top. This is where direction is defined. Trade-offs are made. Value is created.

The problem is straightforward.

Most organizations are still structured—and rewarded—around execution.

And that is precisely where AI is accelerating fastest.

The Illusion of Productivity

Why Working Faster Is No Longer Enough

There is a common belief that using AI to work faster increases value.

It doesn’t. Not in a meaningful way.

Speed without direction only amplifies inefficiency.

I’ve seen teams generate more reports, more dashboards, more analysis than ever before—yet decision quality remains unchanged.

Why?

Because productivity is not the constraint anymore. Clarity is.

AI removes friction from execution. But it does not decide what matters.

That responsibility remains human.

And that is where the real shift in relevance is happening.

AI Is Not a Technology Problem

It’s a Leadership and Value Allocation Problem

Let’s challenge a popular narrative.

“Organizations need better AI strategies.”

In my experience, most don’t have a strategy problem. They have a value perception problem.

They are still assigning importance based on effort, not impact.

They reward:

- Hours spent

- Tasks completed

- Activity levels

While AI is quietly shifting value toward:

- Decision quality

- System thinking

- Outcome ownership

This mismatch creates friction.

Leaders invest in AI tools but expect traditional behaviors to deliver results.

That will not work.

AI does not transform organizations.

Leadership clarity does.

What Staying Relevant Actually Looks Like

A Practical Shift in How You Operate

Relevance today is not about mastering AI tools. It is about repositioning how you contribute.

At early career levels, the shift is from doing tasks to understanding why those tasks exist.

The moment someone starts questioning the purpose behind work, they begin moving up the value chain.

At mid-level roles, the shift is from managing people to designing systems.

The best managers I’ve worked with are not the ones chasing updates. They are the ones who remove the need for updates.

They build clarity into the system.

At senior levels, the shift is more demanding.

AI is no longer a support function. It is a business lever.

Revenue models are changing. Cost structures are compressing. Risk surfaces are expanding.

Leaders who see AI only as efficiency are missing its real potential—and its real threat.

The Three Non-Negotiables

Where Leaders Must Double Down

Across all roles, three capabilities are becoming essential.

AI Fluency

Not technical depth, but a working understanding. Enough to ask the right questions and challenge assumptions.

Domain Depth

AI can generate answers. It cannot replace context built over years of experience.

Learning Speed

This is the multiplier. The faster you adapt, the longer you stay relevant.

Miss one, and your growth slows.

Miss all three, and your relevance erodes quietly.

The 90-Day Reality Reset

What Leaders Should Do Now, Not Later

Transformation does not require a multi-year roadmap to begin. It requires a shift in behavior.

In the first month, exposure matters. Use AI in daily work. Not as an experiment, but as a habit.

In the second month, application matters. Integrate it into real workflows. Replace parts of your process.

In the third month, integration matters. Redesign how work gets done. Remove steps. Simplify decisions.

This is where most leaders stop short.

They experiment. They pilot. They discuss.

Very few redesigns.

And that is where the real advantage lies.

Strategic Takeaways for Leadership

- AI is compressing execution. Value is moving upward

- Productivity gains without decision clarity create noise

- Middle layers will shrink unless they evolve into system roles

- Leadership must redefine how value is measured and rewarded

- Speed of adaptation will outperform depth of experience alone

This is not a future scenario. It is already unfolding.

The Shift Is Quiet, But It Is Decisive

AI will not replace leadership.

But it will expose weak leadership.

Because when execution becomes easy, what remains is judgment.

Clarity. Direction. Accountability.

That is where relevance now lives.

And that is where leaders must operate.

#AI #Leadership #CIO #DigitalTransformation #FutureOfWork #EnterpriseStrategy #Innovation #BusinessTransformation #TechnologyLeadership #ExecutiveLeadership

AI Is Reallocating Value—Not Jobs: Who Wins, Who Struggles, and Why.

Sanjay K Mohindroo

AI is not eliminating jobs—it is shifting value across roles. A strategic perspective on who wins, who struggles, and what leaders must do now.

AI is not eliminating work. It is shifting

where value sits inside organizations.

Execution is becoming cheaper. Judgment, context, and systems thinking are becoming

scarce.

The winners will not be those who work harder. They will be those who move closer to decision-making and value creation.

This shift is already underway. Most organizations just haven’t labeled it yet.

The Quiet Shift Leaders Are Missing

In boardrooms, the conversation still circles a

familiar concern:

“Which jobs will AI replace?”

It’s the wrong question.

After three decades of leading technology transformations across industries, I’ve learned that disruption rarely announces itself clearly. It shows up as small shifts in relevance. A role loses a bit of influence. A team becomes slightly less central. Decisions move elsewhere.

And then one day, the structure looks completely different.

That’s what AI is doing right now.

Not with noise. With precision.

The real shift is not job loss.

It is value migration.

And if you don’t track where value is moving, you will miss where your organization is weakening. #Leadership #AI #CIO

Blue Collar Work Is Not Disappearing. It Is Being Elevated

From effort to oversight

On the ground, the change is visible but often misunderstood.

Machines are taking over repetitive execution. That part is clear. What is less discussed is what replaces it.

The role is not vanishing. It is being reshaped.

Work is moving from:

- Doing tasks

- To manage machines that perform those tasks

This sounds incremental. It is not.

The skill set shifts from physical execution to:

- Interpreting machine output

- Diagnosing issues

- Adjusting processes in real time

The gap between those who adapt and those who don’t will widen quickly.

I’ve seen this pattern before in manufacturing transformations. The highest performers were not the fastest operators. They were the ones who understood the system behind the machine.

That principle now applies across sectors.

White Collar Work Is Facing Its First Real Compression

Execution is no longer a differentiator

For years, white-collar roles were protected by complexity.

Writing reports, analyzing data, and creating presentations—these were considered skilled tasks.

AI has changed that equation almost overnight.

Execution is becoming:

- Faster

- Cheaper

- Widely accessible

Which means it is losing value.

The real shift is subtle but powerful:

From:

- Completing tasks

To:

- Defining the right problems

That distinction separates relevance from redundancy.

AI can generate answers at scale.

It cannot determine which questions matter in a business context.

That requires:

- Judgment

- Context

- Experience applied with clarity

This is where leaders must recalibrate expectations.

High output is no longer impressive.

High-quality thinking is.

#FutureOfWork #DigitalTransformation

Middle Management Is at an Inflection Point

Coordination is being automated out of existence

If there is one layer where the impact will be most visible, it is middle management.

For decades, organizations relied on managers to:

- Track progress

- Coordinate teams

- Escalate issues

- Consolidate reporting

AI is quietly absorbing much of this.

Dashboards replace status meetings.

Automation replaces follow-ups.

Real-time data replaces summaries.

This creates an uncomfortable reality.

Managers who rely on coordination as their core value will find themselves squeezed.

The role is not disappearing. It is evolving.

The new expectation is clear:

- Design systems

- Enable flow of work

- Remove friction at scale

In simple terms, managers must shift from controlling work to architecting work.

That is a very different capability.

Leadership Is Entering a Continuous Strategy Cycle

Planning is no longer periodic

At the executive level, the shift is more strategic—and more demanding.

AI is accelerating:

- Market signals

- Competitive moves

- Customer expectations

The traditional planning cycle is under pressure.

Annual strategy reviews are starting to look outdated in fast-moving environments.

The new reality is continuous adaptation.

Leaders must now:

- Reassess assumptions more frequently

- Make decisions with incomplete data

- Act faster without losing direction

This is not about reacting. It is about staying aligned while the ground moves.

In my experience, the leaders who succeed here are not the most technical. They are the ones who maintain clarity under pressure.

AI amplifies complexity. Leadership must simplify it.

#CIO #BusinessStrategy #AILeadership

AI Is Not Eliminating Jobs. It Is Exposing Mediocrity

The real disruption is not where most people are looking

There is a widely accepted narrative:

AI will replace jobs, and new jobs will emerge.

That framing is incomplete.

What AI is actually doing is exposing the difference between:

- Value creators

- Task performers

Average performance used to be sustainable. Organizations had enough inefficiency to absorb it.

That buffer is shrinking.

AI does not tolerate mediocrity well. It replaces it quietly.

This is uncomfortable but necessary to acknowledge.

Experience alone is losing weight.

Effort alone is not enough.

Titles do not guarantee relevance.

What matters now is:

- Clarity of thinking

- Ability to adapt

- Ownership of outcomes

This is not a technology shift. It is a performance shift.

And most organizations are not ready to address it openly.

Strategic Takeaways for Leadership

The implications are direct and actionable:

- Reevaluate role design

Focus on where value is created, not just where work happens

- Invest in thinking capabilities

Problem framing and decision-making must be developed deliberately

- Redefine management expectations

Move from coordination metrics to system effectiveness

- Shorten strategy cycles

Build mechanisms for continuous alignment, not periodic reviews

- Address performance honestly

AI will expose gaps. Leadership must respond with clarity, not avoidance

Direction Will Decide Outcomes

AI is not a future concern. It is a present force.

The shift is already underway. It is just uneven.

Some roles are evolving rapidly. Others appear stable—for now.

But the direction is clear.

Value is moving:

- Away from execution

- Toward judgment and system thinking

Organizations that align early will gain a disproportionate advantage.

Those who delay will not fail immediately. They will drift.

And drift is far more dangerous than disruption.

Because by the time it is visible, it is already late.

#AI #Leadership #CIO #FutureOfWork #DigitalTransformation #BusinessStrategy #WorkforceTransformation #EnterpriseAI #ExecutiveLeadership #TechnologyLeadership

AI Didn’t Evolve Linearly. It Advanced in Bursts—and That Pattern Will Decide Who Wins by 2040.

Sanjay K Mohindroo

A strategic, decade-by-decade analysis of AI evolution from 1940 to 2040, highlighting acceleration cycles, slowdowns, and what senior leaders must do next.

AI has never been a steady climb. It has moved in waves of hype, silence, and sudden acceleration—from early computing in the 1940s to the generative AI surge of today.

Each decade tells a different story:

· Long periods of quiet groundwork

· Sharp bursts of visible progress

· Strategic missteps that slowed adoption

We are now in the fastest acceleration phase in history.

But speed alone is not the story.

The real shift is this:

AI is moving from a technology layer to a decision layer.

For leaders, the question is no longer

“Should we adopt AI?”

It is:

“Where does AI change how we think, decide, and compete?”

The Pattern Most Leaders Miss

Every few years, I hear the same statement in boardrooms:

“AI is finally here.”

It was said in the 1980s.

It was said again in the early 2000s.

And now, it’s said with more urgency than ever.

The problem is not the statement.

The problem is the assumption behind it.

AI didn’t arrive once.

It has been arriving in waves for 80 years.

And unless you understand those waves, you will misread what comes next.

1940s–1950s — The Foundation Era

When computation was born, but intelligence was theoretical

The invention of programmable computers changed everything. Machines could now process instructions at scale.

In 1956, the term “Artificial Intelligence” was formally introduced. Expectations were high. Some believed human-level intelligence was just a few years away.

Reality was different.

Progress was conceptual, not practical.

The computing power was limited.

Data was scarce.

👉 Momentum: Slow, foundational

👉 Signal: High ambition, low execution

1960s–1970s — Early Optimism, Then Reality

The first surge—and the first slowdown

Governments invested heavily. Early models showed promise in problem-solving and symbolic reasoning.

Then came the gap.

Systems worked in controlled environments but failed in real-world complexity.

Funding dropped. Confidence faded.

This became the first AI winter.

👉 Momentum: Early acceleration → sharp slowdown

👉 Signal: Overpromise met under delivery

1980s — The Expert Systems Boom

AI enters the enterprise—briefly

AI made its first serious move into business through expert systems.

Organizations tried to codify human expertise into rule-based systems.

It worked—within limits.

Maintenance was painful. Systems were rigid. Scale was difficult.

By the late 1980s, the enthusiasm faded again.

👉 Momentum: Fast enterprise adoption → quick plateau

👉 Signal: Practical use, but fragile foundations

1990s — Quiet Progress Behind the Scenes

Less noise, more substance

This decade rarely gets attention, but it mattered.

Machine learning started gaining traction.

Statistical models improved.

Data began to grow.

In 1997, IBM’s Deep Blue defeated Garry Kasparov. A symbolic moment.

Still, AI remained niche.

👉 Momentum: Slow, steady progress

👉 Signal: Silent buildup of capability

2000s — The Data Era Begins

AI finds its fuel

The internet changed everything.

Data exploded. Storage improved. Computers became more accessible.

AI started solving narrow, high-value problems:

· Search

· Recommendations

· Fraud detection

Still, it stayed in the background.

👉 Momentum: Gradual acceleration

👉 Signal: Invisible integration into daily systems

2010s — The Breakthrough Decade

From possibility to inevitability

Deep learning changed the trajectory.

Speech recognition, image processing, and natural language took major leaps.

Companies like Google and Amazon embedded AI into their core business models.

AI moved from experimentation to competitive advantage.

👉 Momentum: Rapid acceleration

👉 Signal: AI becomes business-critical

2020s — The Explosion Phase

AI becomes visible to everyone

Generative AI changed the conversation.

Platforms like OpenAI brought AI into everyday workflows.

For the first time:

· Non-technical users engaged directly with AI

· Productivity gains became personal

· Adoption cycles collapsed from years to months

This is not just acceleration.

This is a compression of time.

👉 Momentum: Hyper-acceleration

👉 Signal: AI becomes universal

2030–2040 — The Decision Economy

Where AI stops assisting—and starts shaping outcomes

Looking ahead, AI will shift from:

· Supporting decisions

· To influence and shape them

We will see:

· Autonomous enterprise processes

· AI-driven strategy simulations

· Real-time business model adaptation

The organizations that win will not be the ones with the most AI.

They will be the ones where:

AI is embedded in how decisions are made.

👉 Momentum: Sustained acceleration, with localized slowdowns

👉 Signal: AI becomes infrastructure for thinking

Contrarian Insight — AI Winters Didn’t Kill Progress. They Built It.

Silence is not failure. It is preparation.

There is a common belief:

“Slow periods in AI mean the technology is failing.”

That’s incorrect.

Every so-called slowdown created the next breakthrough.

· The 1970s forced realism

· The 1990s built statistical foundations

· The 2000s created data ecosystems

What looked like stagnation was actually deep infrastructure building

The real risk is not the slowdown.

The real risk is:

👉 Mistaking silence for irrelevance

Many organizations reduced investment during quiet phases.

They paid the price when acceleration returned.

Leadership lesson:

Stay engaged when the noise drops. That’s where advantage is built.

Strategic Takeaways for Leaders

AI evolution offers very clear signals:

1. Speed will not be consistent

· Plan for bursts, not linear growth

2. Competitive advantage shifts quickly

· What differentiates today becomes baseline tomorrow

3. Capability builds during quiet phases

· Invest when others pause

4. AI is moving up the value chain

· From execution → to decision-making

5. Leadership readiness matters more than technology

· Most failures are not technical. They are strategic

This Time, It’s Structural

AI is no longer an emerging capability.

It is becoming part of how organizations:

· Think

· Decide

· Compete

The past shows us something important:

· The winners are not those who react fastest during hype cycles.

They are the ones who:

· Stay consistent during slow phases

· Move decisively during acceleration

We are now entering a phase where AI is not optional.

It is structural.

And structure, once formed, does not reverse easily.

#AILeadership #DigitalTransformation #CIO #FutureOfWork #EnterpriseStrategy #Innovation #TechnologyLeadership #BusinessTransformation #ExecutiveLeadership

Twenty Years Forward: Quiet Truths from the Long Road of IT Leadership.

Sanjay K Mohindroo

Hard truths, calm lessons, and lived wisdom I wish I had at the start of my IT leadership path.

Early IT leadership often feels like a race. Faster systems. Bigger teams. Louder wins. With time, a calmer truth emerges. Impact grows from judgment, trust, and restraint far more than from speed or tools. This post reflects on lessons that only show up after years of tough calls, failed bets, late nights, and silent wins. It speaks to leaders who want a durable impact, not short applause. It shares case studies, clear views, and firm opinions. It invites debate. And it asks one honest question. What would you tell your younger self if you cared less about praise and more about results that last?

Twenty years of IT leadership compress into quiet lessons on judgment, trust, and choices that last.

The First Promotion Feels Like Arrival

The real work starts after

The first big role in IT leadership feels final. You manage teams. You approve budgets. You sit in rooms where choices shape years. At that point, most leaders think skill and drive will carry them. That belief fades fast.

The job stops being about what you know. It becomes about how you decide under doubt, how you treat people when stress peaks. How you act when data is thin, and pressure is high. These lessons rarely show up in books or talks. They arrive through cost.

If I could speak to myself twenty years back, I would not hand over tools or trends. I would share a mindset. One that saves time, trust, and energy. One that turns IT from a service unit into a source of strength.

This post is written for those who sit between code and consequence. It is written with respect. It is written without polish. It is written to spark comments.

Early Confidence Meets Reality

Skill wins entry. Judgment wins trust

At the start, technical skill opens doors. You fix outages. You ship systems. You impress peers. That phase ends fast.

Leadership tests a different muscle. Judgment.

I once pushed a large system change because the design felt clean. The data looked sound. The team was ready. What I missed was timing. A sales cycle was at risk. A partner was not ready. The launch hurt trust. Not because the system failed, but because the call ignored context.

Case Study

A global bank rolled out a risk platform upgrade mid-quarter. The tech passed every test. The business lost two weeks of deal flow. The CIO owned the call. After that, the release boards added one new rule. Business rhythm matters as much as code quality. The rule stayed.

Judgment grows when leaders pause. When they ask one extra question. When they weigh impact beyond the screen. #ITLeadership #DecisionMaking

Technology Is Rarely the Core Problem

People and incentives shape outcomes

Most failed IT efforts are blamed on tools. That story comforts teams. It is often wrong.

Systems reflect structure. If teams pull in different directions, no platform fixes that. If goals clash, dashboards lie.

I once inherited a data program that burned millions. Each group had clear targets. None aligned. The fix was not new tech. It was a shared goal and one owner with teeth.

Case Study

A retail firm invested in a cloud data stack. Reports stayed slow. Teams blamed vendors. A review showed six owners, each measured on local goals. The CEO reset incentives. One leader took charge. Output improved in one quarter. The stack stayed the same.

IT leaders who see this early save years. #OrgDesign #TechAndPeople

Visibility Is Not the Same as Value

Quiet systems beat loud launches

Early leaders chase visibility. Big decks. Bold claims. Stage moments. That habit fades with scars.

The most valuable systems often run silently. Identity layers. Payment rails. Core data pipes. When they work, no one claps. When they fail, everyone shouts.

I once delayed a flashy launch to harden a core service. The delay drew heat. Six months later, a peer team faced a breach. Our system held. Silence felt better than praise.

Case Study

A health network skipped a public AI rollout. Funds went to data hygiene and access control. Two years later, they scaled models with speed and trust. Others paused due to risk gaps.

Strong leaders pick boring wins. #DigitalTrust #ResilientSystems

Speed Without Direction Burns Teams

Pace needs a point

Fast teams look good. Until they break.

In my early years, I pushed pace as proof of drive. Burnout followed. Errors rose. Good people left.

Speed matters. Direction matters more.

Leaders set the tempo. Not with slogans. With tradeoffs. With what they say no to.

Case Study

A product firm doubled sprint goals to match rivals. Output rose for one cycle. Quality dipped. Attrition climbed. A reset, cut scope, and raised focus. Velocity fell on paper. Value rose.

Teams last when leaders protect energy. #SustainableTech #TeamHealth

Data Never Speaks Alone

Context gives numbers meaning

Dashboards seduce leaders. They look sharp. They feel solid. They hide gaps.

Data shows patterns. It never shows motive. It never shows fear. It never shows skill.

I once backed a cost cut based on clean charts. The numbers hid a truth. A small team held deep system knowledge. Cuts saved money. They cost months later.

Case Study

A telecom firm cut ops staff after uptime gains. Metrics looked strong. Recovery times worsened. Hidden expertise walked out. Rehires cost more.

Leaders read data. They also read rooms. #DataWisdom #LeadershipJudgment

Security Is a Leadership Choice

Risk grows in silence

Security is framed as tech work. It is a values test.

Shortcuts happen when leaders reward speed alone. Breaches follow when no one wants to slow the train.

I once stopped a release hours before launch due to a weak access flow. The backlash was loud. The risk was real. Weeks later, a similar flaw hit a peer firm. The pause paid off.

Case Study

A SaaS firm tied exec pay to uptime and growth. Security lagged. A breach forced a reset. Incentives changed. Posture improved.

Leaders signal risk tolerance every day. #CyberRisk #LeadershipSignals

Influence Beats Authority Over Time

Titles open doors. Trust keeps them open

Early leaders lean on role power. It works once. Then fades.

Long-term impact comes from influence. From listening. From calm pushback. From showing you care about shared wins.

I learned this after losing a strong architect. The exit note was clear. Decisions felt forced. Voice felt small. I changed how I led. Outcomes changed, too.

Case Study

A CIO faced shadow IT growth. Bans failed. Forums worked. By listening first, the CIO shaped the standards the teams wanted to follow.

Authority fades. Influence compounds. #TechCulture #ModernLeadership

Strategy Lives in Tradeoffs

Every yes hides a no

Young leaders chase full plates. Mature leaders choose.

Strategy is not vision text. It is what you stop.

I once joined every request to please all. Roadmaps broke. Focus died. A mentor said one line. Pick pain now or chaos later.

I picked pain.

Case Study

A global firm cut project count by a third. Leaders faced heat. Delivery improved. Staff morale rose. The cut stayed.

Clear tradeoffs earn respect. #TechStrategy #Focus

Careers Are Long Games

Reputation outlasts roles

Early wins feel final. They are not.

Your name travels. How you act in stress stays. How you treat people echoes.

I have hired peers I once worked with. I have lost chances due to past calls. Both felt fair.

Case Study

A CTO known for calm crisis handling kept roles through shifts. Peers trusted his style. Others with louder wins faded after missteps.

Think long. #CareerCapital #LeadershipLegacy

The Real Promotion Is Perspective

Twenty years reshape ambition. The goal shifts from being right to being useful. From speed to strength. From noise to trust.

If I could share one truth with my younger self, it would be this. Leadership is less about pushing and more about choosing. Choosing when to act. When to wait. When to protect people. When to say no.

The best IT leaders do not chase the spotlight. They build systems, teams, and norms that hold when things go wrong.

If you disagree, say so. If you see gaps, point them out. If your path taught you other truths, share them below. That is where real insight lives.

#ITLeadership #CIOPerspective #TechStrategy #DigitalTrust #LeadershipJudgment #EnterpriseIT #TechCulture

Crisis Communication When Code Breaks and Trust Holds.

Sanjay K Mohindroo

When systems fail, trust is on the line. This post explores how IT shapes calm, clarity, and credibility during major technology incidents.

Technology incidents no longer stay in server rooms. They surface in board meetings, news feeds, investor calls, and public memory. In these moments, IT does far more than restore systems. IT sets tone, pace, and truth. Crisis communication is no longer a side task handled after recovery. It is a core technical skill, as vital as uptime, security, and scale.

When outages hit, words matter as much as fixes. This post explores how IT leaders shape trust during technology crises.

This post argues a clear position. Crisis communication belongs inside IT leadership, not outside it. The teams closest to the systems must also be closest to the story. When IT owns the narrative with clarity and speed, trust holds even when systems fail. When IT stays silent or vague, damage spreads faster than any outage.

Through real case studies, strategic insight, and blunt lessons, this piece shows how IT teams can shape confidence during chaos. It invites senior leaders to rethink incident response as both a technical and human discipline. It also invites debate. Strong views deserve strong replies. #CrisisCommunication #ITLeadership #IncidentResponse

When silence costs more than downtime

Every outage creates two problems. One is technical. The other is human. The technical problem has logs, metrics, and a root cause. The human problem has fear, doubt, and anger. Most firms solve the first and underestimate the second.

Customers forgive failure. They do not forgive confusion. They accept risk. They reject silence.

Crisis communication is not public relations paint. It is a system of truth delivery under stress. IT teams already work under stress. They understand systems, limits, and tradeoffs. That makes them the right owners of the message.

This is not about spin. It is about clarity. It is about speaking early, staying factual, and showing control. In every major technology incident, communication speed rivals recovery speed. Sometimes it matters more. #TechIncidents #TrustInTech

Communication is part of system design

Most IT leaders treat communication as a layer added after failure. That thinking is outdated. Communication is part of the system itself. It shapes user behavior, market response, and internal focus.

When a system fails without clear updates, users flood support lines. Executives panic. Teams lose focus. Recovery slows.

When a system fails with steady updates, users wait. Leaders back the team. Engineers work with fewer distractions.

This is not a theory. It is a pattern. Crisis communication reduces the load on the system. It preserves decision space. It buys time.

IT leaders who plan messaging with the same rigor as backups and failover outperform peers in every public incident. #SystemDesign #DigitalTrust

Case study: Cloud outage and the power of radical clarity

A major cloud provider faced a regional outage that took down thousands of services. The technical fault was complex. The response was simple. The status page is updated every ten minutes. Each update named affected services, current actions, and honest limits.

No promises. No vague phrases. No marketing tone.

Customers shared the updates themselves. Social channels stayed calm. Enterprise clients held calls but did not threaten exit. Trust held.

Contrast this with other outages where updates lagged or used soft language. Those incidents led to headlines, churn, and executive apologies.

The lesson is sharp. Accuracy beats optimism. Frequency beats polish. #CloudReliability #Transparency

The leadership shift: IT as the voice of truth

During incidents, many firms push communication upward to legal or brand teams. This adds delay and dilution. Each filter strips technical meaning.

IT leaders must claim a different role. They must become the voice of truth. Not the final approver of words, but the source of facts.

This requires skill. Engineers do not always enjoy writing for public view. That can be trained. Silence cannot.

The best IT teams prepare message templates during calm periods. They rehearse incident updates like fire drills. They define who speaks, where, and how often.

This is not soft work. It is operational readiness. #ITStrategy #OperationalExcellence

Case study: Financial platform breach and trust recovery

A global payment firm suffered a data breach that exposed user data. The breach was serious. The response was faster than expected.

Within hours, the firm issued a clear statement written with input from senior IT security staff. It explained what was known, what was not, and what users should do next.

Daily updates followed. Each update stayed factual. Each admitted limit.

The market reaction surprised analysts. Share price dipped but recovered within weeks. Customer churn stayed low.

Post-event analysis showed a key factor. Users felt respected. They felt informed. They felt the firm stayed in control even while under attack.

This was not luck. It was disciplined crisis communication led by IT. #CyberSecurity #BreachResponse

The human factor: Calm language shapes calm behavior

Language matters during stress. Words shape emotion. Emotion shapes action.

When IT messages sound defensive, users become hostile. When messages sound calm, users mirror that calm.

Short sentences help. Clear verbs help. Avoid jargon unless needed. Avoid blame at all costs. Focus on the present action.

Do not say teams are working hard. Say what teams are doing. Do not say the service will return soon. Say what must happen before it returns.

These choices feel small. They change outcomes. #UserExperience #IncidentManagement

Case study: Internal outage and employee trust

A large enterprise suffered an internal system failure that blocked payroll access. The outage did not hit customers, but it hit staff trust.

The IT team sent an internal update within thirty minutes. It explained the issue, the risk window, and the expected next update time. Leaders echoed the message without edits.

Employees stayed patient. Managers stayed aligned. No rumors spread.

In a similar firm, a similar outage caused anger and confusion due to delayed and vague internal messages.

Crisis communication applies inside the firewall as much as outside it. #InternalComms #WorkplaceTrust

The technical discipline

Building communication into incident response

Crisis communication must sit inside incident response playbooks. Not as a footnote. As a core track.

Every incident plan should answer simple questions. Who writes the first update? Where it goes. How often do updates repeat? Who approves facts, not tone.

Metrics should include communication lag. Track time from detection to first message. Track update cadence.

Teams that measure this improve fast. Teams that ignore it repeat mistakes.

Communication is a system. Measure it like one. #SRE #ResilienceEngineering

Risk and truth

Saying less hurts more

Many leaders fear saying the wrong thing. That fear leads to silence. Silence creates speculation. Speculation multiplies risk.

The safer path is narrow and clear. Say what is known. Say what is unknown. Say when the next update will arrive.

Do not guess. Do not promise. Do not hide.

Truth told, early reduces legal risk more than delayed polish. This is proven across sectors. #RiskManagement #CorporateTrust

The cultural signal

Incidents reveal leadership values

Every crisis acts as a mirror. It shows how a firm treats users, staff, and truth.

When IT leads with openness, it signals confidence. It tells teams that facts matter more than fear.

This builds long-term credibility. Not through slogans, but through repeated behavior under stress.

Technology changes fast. Trust changes slowly. Protect it with intent. #LeadershipCulture #DigitalResilience

The challenge to leaders

Stop outsourcing the narrative

If you lead IT, this message is direct. Own the narrative during incidents. Not the blame. The facts.

Build communication skills in your teams. Practice them. Measure them.

If you lead the business, let IT speak. Do not slow truth with layers.

Crisis communication is not an add-on. It is a core capability in modern technology leadership. #CIO #CTO

When systems fail, leadership speaks

Failures will happen. Complexity guarantees it. What defines strong firms is not failure rate alone. It is response quality.

IT holds a rare position. It sees the system and shapes the message. When those align, trust survives stress.

The next incident will test more than code. It will test clarity, courage, and control. Prepare now. Speak early. Stay honest.

The conversation does not end here. It begins here. Share your view. Disagree if you must. Strong systems are built on strong debate. #CrisisLeadership #TechTrust

#CrisisCommunication #ITLeadership #IncidentResponse #DigitalTrust #TechIncidents #CyberSecurity #OperationalResilience #CIO #CTO

When Great Tech Falls, Leaders Rise.

Sanjay K Mohindroo

Leadership lessons carved from iconic technology failures

When big tech breaks, leaders reveal their truth. Sharp lessons on judgment, culture, and courage from famous failures.

Technology failure is not rare. Poor leadership is. This piece explores iconic tech collapses to surface the real lesson. Systems fail, markets shift, and code breaks. Leadership choices decide the outcome. From missed signals to rigid cultures, each case shows patterns that repeat across eras and sectors. These lessons matter for senior leaders who build teams, shape culture, and steer risk. Failure is not the villain. Silence, delay, and ego are.

Great tech failed. Leaders shaped the fall. The lessons still matter.

Every leader enjoys growth stories. Few studies collapse with the same care. That is a mistake.

Failure is the sharpest mirror a leader will face. It strips away slides, titles, and noise. It shows how decisions were made when signals were weak, when fear crept in, and when pride spoke louder than facts.

Technology fails in public. Code breaks fast. Markets respond faster. The story that follows is not about bad tools. It is about human choice under pressure.

The leaders who study failure gain an edge. They spot risk early. They build cultures that speak up. They act before charts turn red. This is not about blame. It is about clarity.

Let’s walk through the lessons written in the wreckage of famous tech falls. #Leadership #TechStrategy

A Pattern Behind the Collapse

Comfort breeds blind spots

Most iconic failures share a calm before the fall. Revenue looks solid. Brand trust feels earned. Leaders relax.

This calm is dangerous. It rewards past wins, not future truth. Signals that challenge the core story get brushed aside. Teams stop arguing. Meetings get quiet.

Leadership sets this tone. When leaders prize comfort over debate, the system drifts. The market never waits.

Failure starts long before headlines. It begins when leaders stop asking hard questions. #LeadershipMindset

Case Study: Nokia

Speed lost to pride

Nokia once ruled mobile phones. Its scale was unmatched. Its supply chain was world-class. Its fall was not due to a lack of skill.

The threat was clear. Touch screens. App stores. New user habits. Engineers saw it. Middle leaders flagged it. Senior leaders stalled.

Internal fear slowed action. Teams protected turf. Leaders doubted outside ideas. The firm had technical skills but a weak belief in change.

The lesson is direct. Market shifts demand fast trust in teams closest to reality. Leaders who wait for full proof arrive late.

Speed is a leadership choice. #DecisionMaking #TechLeadership

Case Study: Kodak

Vision blocked by profit comfort

Kodak built the digital camera. It still failed to lead digital photos. This was not irony. It was fear.

Film margins were rich. Digital felt thin. Leaders chose to protect the old cash engine. They delayed a future they already saw.

The deeper flaw was not tech. It was an incentive design. Leaders tied rewards to legacy profit. Teams learned what not to push.

The lesson is blunt. If leaders tie rewards to yesterday’s win, tomorrow’s work dies. #Strategy #Innovation

Case Study: BlackBerry

Users ignored; culture locked

BlackBerry defined secure mobile work. Leaders believed that the edge was enough. Users disagreed.

People wanted ease. They wanted to touch. They wanted fun mixed with work. Feedback was clear. Leaders dismissed it as noise.

Culture blocked truth. The firm prized control over change. Leaders trusted past buyers more than future users.

The leadership lesson here is sharp. When leaders stop listening to users, decline is certain. Products serve people, not plans. #CustomerFocus

Case Study: Boeing and the 737 MAX

Pressure beats judgment

This failure was not about tech skills. It was about trade-offs. Speed to market beats safety margin. Cost beats caution.

Engineers raised alarms. Process moved on. Leaders trusted systems over signals. The result was tragic.

The lesson is heavy but clear. Leadership must set red lines that profit cannot cross. When leaders blur those lines, risk turns real.

Trust once lost is hard to earn back. #Risk #Governance

Case Study: Theranos

Silence sold as vision

Theranos promised magic. Leaders enforced silence. Dissent was punished. Data was hidden.

This was not a tech failure alone. It was a leadership failure rooted in fear and control. Vision became shield. Facts became a threat.

The lesson is stark. Leaders who crush doubt also crush truth. Without truth, systems rot fast. #Ethics #Culture

Signals Leaders Miss

Weak signs speak first

Failure sends whispers before it shouts. Small bugs. Missed dates. Rising staff exits. User churn.

Leaders often dismiss these signs. They wait for big proof. By then, options shrink.

Strong leaders act on weak signals. They ask teams to stress the plan. They reward early warning. They listen without anger.

The skill is not genius. It is discipline. #LeadershipSkills

Culture Is the Real Stack

Tools follow trust

Every failed firm above had talent. What they lacked was safe truth flow.

Culture decides which facts travel up. Leaders shape culture with every reaction. Praise curiosity, and it grows. Punish doubt, and silence spreads.

No dashboard saves a culture that fears truth. Leadership behavior sets the real system design. #OrgCulture

Speed Versus Care

Balance beats bravado

Leaders often frame speed and care as rivals. That is false. True speed comes from clear rules and trust.